I was scared. In October 2010, right after our second child was born, I was sick and tired of feeling the weight of financial strain on our life. I felt a huge burden handling our finances and Ernie felt a burden wondering why he made a decent salary, yet we never seemed to have much left over. We were “just fine,” but like everyone else, we lived paycheck to paycheck. That means, if something major were to happen (job loss, major sickness, etc), and one check would not come in, we would have a situation. It’s these major life events that get people into a real pickle, and debt plays a really big part – more than we knew.

We have always been pretty frugal and always paid our bills on time. So, of course, because of this, we had great credit. We could basically finance anything we wanted to. So, we did!

We thought we were doing well financially because we had such good credit. We thought that’s how you buy big things – on credit. That’s what it seemed like everyone else was doing, so we did too! People don’t actually save money to buy a car with cash do they? “Yeah right,” I thought, “that’s for rich people I guess.”

Eventually, after about 6 years of marriage, I felt the strain of possibly not being on time for a house payment. So, I was trying to figure out which was cheaper – the late fee on the mortgage or the overdraft fee from the bank.

Then I told Ernie about it, and he’s wondering where all our money is going. I had nothing to hide; it’s not like I had a bad shopping habit or gambling secret, but obviously I wasn’t doing something right. He then wanted a list of all our bills to see what was going on. He says, “I heard this guy on the radio. I don’t remember his name, but all I know is that he teaches people to get out of debt, and we need $1,000 in savings to get started. People call in to his show and scream ‘We’re debt free!”

I was like, “Where we gonna get $1,000!?!?”

So I made a quick budget, and he and I were surprisingly able to squeeze that starter savings out of our budget and some other money we had set aside. How did we do that so quickly, you ask? Well, at that very moment, we decided which was more important at this point in our life. Saving money or buying a new dress for an event? Saving money or eating out? Saving money or buying a new toy for the kids? – you know, things like that. It’s the little things that add up. And nothing is more important at that very moment than not being able to pay for the roof over your head that you own. That is the first thing you take care of. Sell something if you have to!

Soon, I found out that the guy on the radio that Ernie was talking about was Dave Ramsey. One week later, a friend gave me one of Dave’s books, The Total Money Makeover, and it was so empowering, encouraging, and motivating! I felt like we could definitely use this in our life. The book made me feel like we could do it, and I wanted to hit the ground full speed.

But, there was a catch. Although Ernie led me to Dave Ramsey, after reading his book I knew what we needed to do to get on top of things (because I’m the one who read the book), but I knew Ernie wouldn’t like the process very much. I mean, come on, it involved cutting down our spending. Who would like that? So as we were on our way to a family reunion, I started reading him some things from the book. We were in the car, so I knew he couldn’t walk away! I’m not sneaky, just smart. He was convinced, and he agreed that we would do it. There was a lot of resistance at first, but we started to make a little progress.

I could start to see a light at the end of the tunnel and I felt like we could get on top of our financial mess – the mess I didn’t even realize we had. I started to realize how horrible debt was, and chasing a credit score is like a dog chasing its tail – you have to be in debt to have a credit score, but no one really wants debt, so we just have it because we think we need it.

I quickly learned that debt is a curse, a lie, a thief, you name it.

Just when you think you have it all together, debt will eventually catch up to you. IT WILL – trust me. I always thought that we would just eventually make more money one day, and that’s how we would start doing better financially – that is also a LIE! Big, fat, lie.

Although this was new to me, it’s not new information to your old grandma; she knows exactly how money works and how to live on less than you make, and she also knows how to save. You should ask her. It’s just that as time went on, debt became normal (and so did “broke”), and now most people have debt and 70% of Americans live paycheck to paycheck – in one of the richest countries in the world. So, then I realized we’re not the only ones! This didn’t make me feel better, it actually made me feel the need to share this information with others!

Dave has a motto that says, “If you will live like no one else, then later you can live and give like no one else.” Some things he said really stuck out to me: You work too hard to be broke! You work TOO HARD to get to the end of your life and end up with nothing! How much could the people of God do for the Kingdom of God if they had no debt?

The Struggle is Real

I just HAD to share this information with our church, so we coordinated our first Financial Peace University (FPU) class in January 2011. After counting up all our debt, I never realized how much we really had. It was small credit cards, medical bills, new car, motorcycle, students loans, etc. We had it all, yet we were normal. We made a decision that we no longer wanted to be “normal.”

The debt totaled about $35,000, plus our brand new, stylish, mobile home. It was then that we learned how to live a whole new way, and how to handle money according to what the Bible teaches. The first few weeks into the class, we had already cut up all our credit cards and decided we were no longer borrowing money again, not even for a car. We actually sold our new car back to the dealership and bought a car with 180,000 miles on it!

Ernie worked offshore a lot so he didn’t always make the classes (not a good plan, by the way). So I would just fill him in, and try to encourage him as much as I could. I’d also like to add that Ernie and I were never on the same page when it came to finances, and it usually would start up some type of disagreement. After taking the FPU class, it brought us closer in a whole different way and really made us strive to work together. It was extremely difficult to change our habits, but we managed to pay off quite a bit of debt in the beginning of our journey – $15,000 in less than a year!

I don’t think we fully understood the power of completely working together as husband and wife in every area, and I just continued to live out these new money principles and still handled all the finances on my own. Again, not a good plan. Even though things were much better, after about a year and a half I felt like we were somehow slowly getting back to our old habits. I started to feel the pressure again of not having enough money and dipping into our “starter” emergency fund. Another year passed, and here we were still in debt, when I planned for us to get out of debt within 2 years.

During this time, we ended up getting a Discover card to pay for a rental car to go visit my brother in North Carolina, and then continued to use the card and pay it back every month – you get all those “Cash Back” points, right? We started using the card for all of our purchases just like if it was a debit card, then we’d pay it back every month. We would average about $25 per month in rewards through the cash back. How dumb – all for $25? I read about how not to do that in Dave’s book and still did it anyway. Well, turns out Discover is way smarter than the average consumer, and we were spending way more using that card than if we would have just budgeted our money and used our own money. Oh believe me, credit card companies know that very well. They do tons of research on it. But anyways, this whole time we were using the credit card we did not pay any extra on our debt. We couldn’t – we were overspending.

We also made a car loan for a car for Ernie since he was switching jobs and would lose his company truck. He was starting a job where his salary would be about a third more, so I just knew we would be better off and that burden would be lifted finally. So then I lost the battle between buying a $3,000 car for him to get back and forth to work (my idea), rather than buying an $11,000 car (his idea). Not long after, we had our third child. After going through two miscarriages in the past year, we then had a successful pregnancy for our baby girl, and she was born on October 29, 2013.

Therefore, realize that there were many expenses included during these years of trying to pay off our debt. But, I never gave up. I couldn’t continue saying, “We’ll just never get ahead…” and “I guess that’s just how life is…” or “We just a soon not even try.” No. There was a fire that burned in me constantly saying that we needed to do something different.

Fix the Mistakes

So even though the new salary was great, we didn’t change our bad habits all that much right away. Again, not a good plan. I’ve heard Dave say it before, “If you want something different, you must do something different.” If you’re still living the same as before the mistake, you WILL end up with the same result!

I was still doing a monthly budget, but I was fixing the spending mistakes on the budget after we would make them (don’t do that). Instead, you must prevent the mistakes from happening as much as possible by putting a stop to impulse spending. I just couldn’t figure out why we couldn’t save extra money and leave it alone. Stuff just kept coming up. It was always something.

I know you’ve heard that before, “It’s always something. We just can’t get ahead.”

On our budget, in the beginning of the month, the money that was shown that would be left over at the end of the month would just disappear by the end of the month!

But as I looked back, we were still taking small vacations, still eating out, buying things we didn’t really need, etc. And I bet everyone thought we were doing well. Looks are deceiving. You just can’t keep living like that when you are trying to get ahead. You will never get ahead.

This went on for like a year. I started to feel the weight even more, and I had enough. I read The Total Money Makeover again and got so motivated again, I wanted to sell everything we owned!

Staying motivated is key. I wanted to figure out a way to make some extra money so we can get this done faster, but I have 3 little kiddos and it was summer time. I have a small side business but it wasn’t steady, so I went back to work as a server at night when Ernie got home. I knew I could make some quick cash with a little elbow grease.

Where there’s a will, there’s a way. You can do anything you really want to do. When Ernie wasn’t home in time, I would bring the kids to a friend and their Nana’s house until he got off of work. After three months of that, we called it quits. We were finally starting to see a turnaround, but Ernie hated his new job, and it only got worse for him at work. He started to lose weight from so much stress, and if you know Ernie, he does not need to lose any weight as it is!

When I had read Dave’s book again, I figured out all the areas where we went wrong the first time, and this is when I asked Ernie to be more involved in the finances and decided we also needed to ditch the Discover card. I cannot make all the financial decisions anymore, and I let him know how much it was stressing me out. So, we decided that every time we got paid and I would prepare the budget, it would get emailed to him so he could look it over, and anything that needed to be changed would be discussed. We needed to try our best to stick to it. All extra money at the bottom of the budget would need to be allocated somewhere, not just sit there, since it kept disappearing.

In those few months, we paid off the remaining of his car ($7,000), and also cash-flowed $1,000 worth of medical expenses, a $3,000 Moser 12-bolt rear end replacement, and a $1,500 engine rebuild on his car because of a cracked piston! We had built up our starter emergency fund again, and we were finally getting on top of things. The only debt we had left at this point was about $13,000 in student loans and medical bills.

Then, Ernie was laid off of his job with no warning.

I was actually completely relieved at this point. If we had not started our total money makeover again this would have been a total disaster!! Thank God we were at least somewhat prepared! He wasn’t worried at all, and two days later, he got his old job back! They were just as happy to see him as he was to have a job! That experience made us so thankful for his job, and gave us a new outlook. We decided to really crack down on things.

I also noticed over time that Ernie became more of the financially responsible husband I had been waiting to see. He was even better than me at saying NO to unnecessary purchases now. I needed that in my life because we all need accountability. Without accountability, it’s really hard to stick to these goals. He became my encouragement and partner-in-excellence. Ernie became the man that I could look up to and count on for good decisions.

We had to share our enthusiasm again, so we coordinated another FPU class together. There was no stopping us now.

We Had Enough!

When you get enough of something, you just get enough! We got serious. We had enough. We weren’t taking vacations, we weren’t eating out on a whim unless it was planned for, and we weren’t buying anything we didn’t absolutely need. We wanted to be like all those people in Dave’s book who pressed on through it. We were tired of being stuck. I’ll say it again. If you want a different result, you better do something different.

We also knew that the brand new mobile home we have lived in for about 5 years had to go. It was going down in value, and that’s the equivalent to living in a very expensive car. So, we decided to sell. After an appraisal, it looked as though we would have to pay money to get out of this mobile home, so we accepted that fact. We needed to do what was right. Within 10 days on the market, we got a buyer. Some friends of ours at church, who were not concerned with an earthly investment, bought the home for an eternal investment! How awesome is that?! They were in a position in life to be able to do something like that! Once the home was sold, we didn’t have to come out of pocket with as much as we thought, but it was still a good chunk – about $5,000, which we did save for.

How did I continue to stay motivated?

I was an avid listener of Dave’s 3-hour radio show at this point. It was my motivation fuel, and I don’t know how we would have pushed through without the radio show. I heard him talk about the criteria you should have to buy a home. It’s also listed in his book. We didn’t meet any of that criteria. Even though we would get approved for a home loan, we wanted to do it right this time, and we wanted our life to line up with the Biblical principles he teaches. I knew we would need to rent until we were ready to buy. It was a hard decision, and we got a lot of slack from a lot of people about renting. Renters go to hell, you know. LOL!

“You’re throwing money away!” we heard. Yeah, I’m well aware of the throwing-money-away-sales-pitch, but we chose not to buy a house right away for a few reasons. First of all, short-term renting is not evil, but long-term renting is not smart. Renting for a short time buys you some patience, and if there are any major house repairs, it’s not your house to fix them.

There are some principles to follow in order to set yourself up to win with money. A few things are: Don’t buy a house until you have NO debt, have a fully funded emergency fund (3-6 months of expenses saved), AND either pay cash or have a good down payment on a 15 year fixed-rate mortgage that is no more than 25% of your take-home pay. The reason is simple. Buy a house with debt, and Sallie Mae will need a spare bedroom in your home. Buy a house with no emergency fund, and everything will become an emergency. It will eventually make you more broke. Don’t buy a house on a 30-year, and say you will pay it like a 15-year. Life happens, and other things will always seem more important – prom dresses, a new couch you don’t really need, a veterinarian bill, etc. Plus, a 30 year mortgage lets you borrow more money than you actually should. And there’s also something really special about a 15 year – it always pays off in 15 years.

Even though we’ve bought a house before and didn’t meet these criteria back then, it didn’t matter. We wanted to do it right this time. So we have rented since March of this year, and plan to rent for a year, have all debt paid off, emergency fund, and a down payment. And it’s happening!

Testimonies along the way!

During this time, God also blessed us with the sale of our vehicle with 216,000 miles on it by sending us someone that gave us $1,500 more than what we were asking! What???!!! Yes, this is real. No one does that! God does! Then, we were able to upgrade to a newer vehicle with much less miles, and only had to come out of pocket $500 plus the tax on the car. This purchase was very different from the rest of our car purchases, not only because we paid cash – we took our time and found the right car, with no pressure and no strings attached. It was the coolest thing ever! So many things happened along the way that didn’t make any sense at all! This is just one of them. God has totally blessed this journey!

The Secret Sauce

The last six months have been the greatest at paying off debt at a faster rate because we cut our lifestyle even more. The deeper you cut, the faster it gets paid off. I had also been working hard at extreme-couponing in the past few years and saved us several hundred dollars a month on groceries, and was even featured in the June 2014 issue of Point of Vue magazine!

Ernie took all the extra offshore jobs that he could. We spent more time with our kids on a daily basis taking them outside riding bikes around the neighborhood, to the park, or just get a snowball. Having fun doesn’t have to be expensive, and neither does spending quality time with your family.

We were throwing chunks and chunks at the remaining debt, paying an average of $1,800 per month, with some months at $2,500 and some months at $900. That’s in addition to our rent payment, utilities, groceries, and everything else you need to live on.

For me, staying motivated meant for me to regularly listen to Dave’s radio show/video channel on the Dave Ramsey app. I think for Ernie, staying motivated meant for him to constantly think about the goal we were striving for and think about what he is working so hard for.

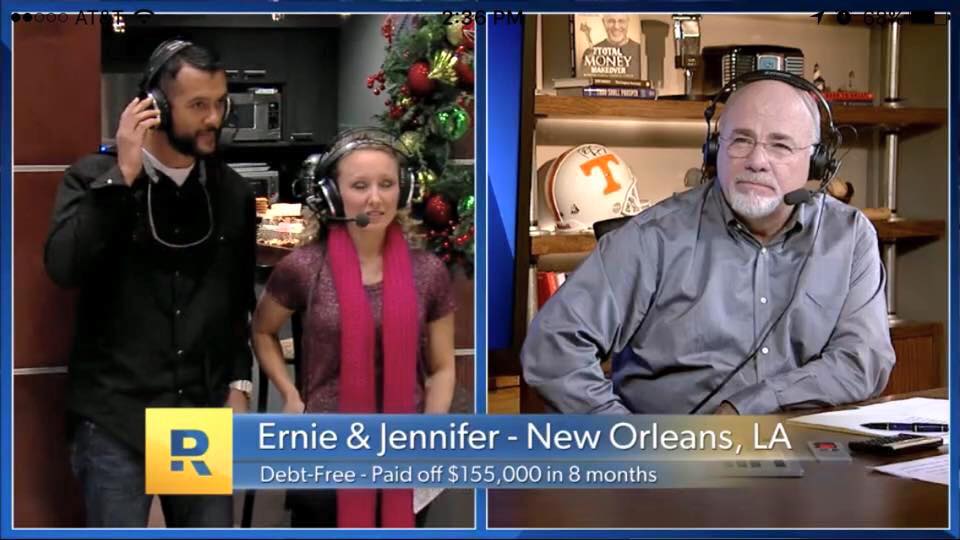

As of September 25, 2015, we are completely DEBT FREE!!! Grand Total of $194,500 paid off in 4 years, 7 months – and we just decided this took way too long! This is because now we realize that the way we’ve done it in the past six months, we could have gotten it done way sooner. But hey, you live and learn, right?

The mobile home sold for $144,000 and we had a total of $50,500 in consumer debt that was paid off over time by cutting our lifestyle and throwing all extra income at it (car, student loans, medical, etc.). I have not been debt free since I was 18 years old, and Ernie was 20! We have so many stories of blessings we have received during this time. There are Biblical principles, that if followed, the Bible says things will happen. They have to; the Bible says so. One of them is, “You will reap what you sow…” always.

We have worked SO hard, and as we dwindled down the debt, God has met us where we were, and poured more blessing over our life. Not just financially, but in every area. We have much bigger goals now. We want to be able to be outrageously generous. But we learned that you can’t do that if you spend everything you make.

We will now be saving for a nice down payment on a home, but it will be a home that is way below what we could really afford. The statistics show that people who follow these principles, on average, pay off their homes in 7 years. We are making plans to visit Dave’s radio show in Nashville to do our public debt-free scream live on air in the midst of 10 million listeners. If you don’t know what this is, you’re totally missing out. These people are such an inspiration, and I cannot wait to make this a big deal for our family. We are officially changing our family tree!

The One Thing We Never Changed

We may have made some drastic changes in our life and cut down on our personal lifestyle, but there is one thing we never cut – giving.

It’s very important to maintain a giving mentality. We have always been faithful givers to our local church. Even in the beginning of this journey when we weren’t sure how we were going to make our mortgage payment, we never once considered not giving. It’s just not in us to not give. We are not in it all for ourselves, but to be a blessing to others. I understand many people feel this way as well, but just can’t ever seem to have extra to give. If that’s you, then start to take this same journey.

We also do not give just to give. We faithfully give to our church as a starting point, and we prayerfully give as the Lord leads us to do extra giving. During this entire journey, we always have and always will have a “giving” category on our budget not included in the church donation. Once it builds up, we look for someone to bless with groceries or any other need we see fit. We are definitely looking forward to making this an even bigger category in the future. That’s what is so fun about it! Giving is the most fun we can have with money, it truly is.

What We’ve Learned

Lastly, the things we learned along the way are priceless.

It’s not all about money. Mainly, we learned about contentment. The real truth is that we buy things we cannot afford with money we don’t even have, mainly to impress others (but most people deny that).

We learned that if you don’t have the money to buy the whole thing, you don’t buy it. It’s actually very simple math. sometimes you just have to make a choice – go on an expensive vacation or use that extra money to save up for a down payment on a home? Our kids will reap major benefits of living this way. They know what is important to us, and it’s not “stuff.” They have already started learning how to give, save, and spend using the Financial Peace principles and by working to earn money.

I also learned that you don’t have to make a wealthy salary to become wealthy and to be generous. You just need to live on LESS than you make, and eventually, you will have the opportunity to be outrageously generous. When you handle money the way God instructs us to, it is only natural that you will become very wealthy (on His terms, since being wealthy doesn’t always mean monetary). Seek ye first the Kingdom. He who is faithful with little will be given much (Luke 16:10).

I hope this is an encouragement to everyone who reads this and to NEVER give up on your goals no matter what happens!

Stay encouraged by joining my email list, and never miss a post!

Thank you SO much for publishing your story! I’m currently reading Dave’s book and struggling to pay down a lot of debt. Your story is encouraging! I’ll download the App and listen to stay motivated. Above all, prayer and gratitude for all the continued blessings. Blessings to you and your family!

Oh I’m so glad our story can encourage you! Other people’s stories encouraged me for sure! You CAN do it!! :))

Thank you so much for sharing your story! I needed the encouragement today.