The thing that keeps Americans the MOST broke is….

car payments.

We always had car payments. It’s just part of life, right?

I’m here to tell you that it doesn’t have to be!

I realize now that the dumbest thing I ever did was trade in my paid-for high school car to get a small SUV. It was after we had our first baby, and we felt like we needed something new. It wasn’t brand new but it was slightly used. We were young and our credit wasn’t too established yet, so we didn’t even get a good interest rate.

Taking on a car payment is one of the dumbest things people do to destroy their chances of building wealth. The car payment is most folks’ largest payment except for their home mortgage, so it steals more money from the income than virtually anything else.

The Total Money Makeover by Dave Ramsey

Nothing was wrong with the car I had. We were just doing what everyone else was doing – getting a nicer ride when the old one gets old. It made us feel good.

Plus, we thought we needed more room with our one baby. Yes the extra room was nice, but when I look back, needing extra room was not necessary to go into debt.

Ohhh, if I only knew what I know now. Experience is the best teacher, isn’t it?

“But we could afford the payments. Then, in 5 years it’ll be paid off.”

I bet you’ve said that, right?

Unfortunately, what a lot of us do is once we pay it off, we get tired of that one and finance a newer one… or we start having trouble with the 6 year-old car and go get a newer one with a car note so we don’t have to spend the money to fix it. We don’t get nearly what we paid for it, but we gotta do what we gotta do – queue the vomit.

Did you know that you can completely rebuild a car about three times over before it would add up to the cost of a brand new car?

Did you know that 9 times out of 10 it’s cheaper to fix your car than to go buy a new one? Even if it’s a $1,000 repair, it’s STILL cheaper to fix it than to finance a new one that WILL keep you BROKE in the long run!

According to Experian’s Q4 2018 State of the Automotive Finance Market report, the average car payment for a new car is about $545 and the average interest rate is 6.13%. The dealership won’t tell you that your brand new car loses 60% of it’s value within the first five years (which is about the length of the loan by the way). After five to six years, you’ve paid almost $33,000 for a 26,000 car, which is now worth maybe $6,000.

On top of that, a recent study showed that 7 million Americans are more than three months behind on their car payments!

5 years 0% interest is NOT the same as cash – no such thing when you’re financing. First, cash gets you a better deal. Flashing Benjamins will have them drooling, trust me.

A little side note: The Dealer doesn’t make the most money on the sale of new cars, the most money is made in the finance department.

Second, most people don’t pay it off after the grace period of no interest and are then stuck with all of the interest tacked on to the back of the loan in the end – all for a car that’s lost 60-70% of it’s value and now worth pennies compared to what you’ve paid for it!

And third, you can’t save that much on the side for another vehicle later when you’ve been paying a note for 5-6 years can you? That’s why most people just end up financing another one over and over, and the cycle continues.

Everyone knows that new cars go down in value like a rock, and they’re still financing them! But whyyyy???

You don’t have to admit it if you don’t want to, but the cold hard TRUTH is that we just love driving around a brand new (or slightly used) car because it makes us feel good inside.

We will use every excuse known to man to justify our financed vehicle decision.

I want my car to have a warranty.

I want a reliable vehicle.

I travel a lot, so I need a brand new car.

It’s what I hear all the time, and it’s what I used to believe too. Until there’s a complete culture shift in the brain, we’ll always believe we need a brand new car.

Maybe you’re thinking that a slightly used car is okay. As long as there’s no payment, then yes, it’s okay. You will pay more for it, but if you have the cash, go for it.

There isn’t much difference in a used car with a payment or a brand new car with a payment, besides the fact that the brand new car loses so much more value. Whatever you can afford with cash, that’s what you can afford. The whole thing. No payment.

The WHOLE truth is that unless you’re a millionaire, you cannot afford to buy a brand new car (even with cash) because you cannot afford to lose that much money. News flash: a car is NOT an investment. Recap: you just bought a $26k car, paid $33k+ for it with interest over 5 years, and now it’s worth $6k… if you’re not a millionaire, you can’t afford to be losing $27,000 every 5 years.

If we’re all honest here, we’d probably say that this is what car payments feel like…

You can laugh now! You know it’s true!

But how do you get to the point to where you can pay cash for a car?

That’s where your good ol’ budget comes in handy. If you’re new to budgeting, or you need a crash course on getting better with your money habits, take my free 5-day eCourse, Creating a Less-Worried Life: Better With Money. I teach the steps we took to get out of debt and turn our finances around forever.

It really does depend on your situation to decide how old and how many miles you’re okay with on your car. For example, Ernie is extremely familiar with a 350 Chevy engine, and he can make the necessary repairs to keep us going. With our Audi, there were a few things that he just couldn’t fix because it’s a foreign car he’s unfamiliar with.

All in all, it’s still NO excuse to finance a vehicle ever again.

I’m about to give you some REAL numbers that Ernie and I discussed and put together for you to see how buying used cars with cash saved us a buttload of money (like, an unbelievable buttload of money).

BEFORE we first began this journey, we had just traded in two vehicles for a brand new 2009 Honda Civic. The dealer gave us what we owed on the two car notes we had, and we financed a brand new car that was still on the lot from the previous year’s design. They were coming out with newer models, so we were able to get this one with a discount. With a very little down payment and the trade-ins, this deal saved us at the time because we were about to be late for the first time on our car payments. We were in a tight spot and needed to do something.

Ernie had a nice truck and I had a slightly used “mommy-mobile” small SUV. Now, instead of two car payments, we had one. Sounds like a bargain, but knowing what we know now, we would’ve actually done that differently.

Again, this was BEFORE we found out the truth about car payments and how they keep you broke. This new car deal only solved our money problems for a little while, you see. That’s how car payments and car leases work for the broke folks. They get us by for a little while. But, if you just keep putting band-aids on everything, you never get down to the root of it.

Two years later, we were becoming broke again. Go figure. Tough financial times were like a cycle for us. We’d be okay for a little while, but then it would come again, and we’d chalk it up to something that wasn’t our fault. We continuously lived paycheck to paycheck and thought that we just didn’t make enough money.

I read a book, took Financial Peace University, and a light went off.

We needed to get rid of car payments.

Forever.

We decided to see what we could get for the Civic using Kelly Blue Book, and surprisingly it was exactly what we owed on it. We were on a mission to find something cheaper that we could pay off faster. We didn’t have the cash to buy a car outright just yet, but we did have a small emergency fund if anything was to happen in the meantime.

Ernie loves car shopping, so he ended up finding a 2003 Cadillac Escalade with 180,000 miles on it.

I’m going to tell you now: This was absolutely the most scary thing to me. 180,000 miles? Are you nuts? We’ve never driven a car with more than 60k miles on it!

We took it for a test drive and sold us for $8,500. It was super clean and in great shape. Do I recommend an $8,500 car for your first car if you can’t afford it? No. I recommend a $2,000 car to get you by for the next 10-12 months until you can save for a nicer one (more on that later). We were new to this.

All I knew was that we had to fit two big car seats and still have room for everything else. I trusted Ernie on this one. I asked him a million times, “Are you sure about this?”

He kept saying, “Yes! I’m not scared of miles!”

Okie dokie then.

Three years later, after we paid off all of our debt, we realized we were driving a big vehicle we thought we needed, but we never used the third row seat. Ernie had a company truck, so it was mainly just me and the kids going from point A to point B all the time. I felt like I didn’t need that big vehicle anymore and was fine with just a car that would get MUCH better gas mileage.

We ended up selling the Escalade for $7,000, which was a total blessing out of nowhere but Heaven.

This would NOW be our FIRST EVER car deal made with CASH! Whoo hoo! We were super excited! We wanted something nice, something I always wanted – an Audi.

We found a super-clean, 2005 Audi A6 with 140,000 miles on it for $7,500.

About two years later, after buying our dream home, Ernie’s company truck was now getting some new company rules to abide by. We could no longer use it for personal use. Therefore, it was time to get a bigger vehicle again. We sold the Audi for $6,500, and found a Chevrolet Traverse LTZ with 150,000 miles for $8,500.

After about a year or so with the Traverse, we had some new things under our belts – Travel baseball, a chocolate Labrador, and lots of packing and loading and traveling. I wasn’t ready for driving a tank, but Ernie was antsy about having more room. I loved the way it drove and hugged me in the driver’s seat (I’m petite), so it was definitely my favorite so far.

We sold the Traverse for $7,000, and found a Yukon XL Denali for $7,500. This vehicle had a little over 200,000 miles on it. Before you pass out, let me clarify that we never intended on keeping this vehicle too long (maybe a year or so). We’re in the process of saving up for something else more important, and we needed to get by with what we can for the moment.

As you can see, these are all really nice cars. People often say that you can’t get a nice car for that price. I beg to differ.

People are scared of repairs (I was, too). BUT even with repairs (even with paying someone else to do it), you would save at least 60% in total vehicle costs over a span of time. The Audi was the most expensive to repair, costing over $2,000 in repairs because Ernie couldn’t work on it himself. Even still, we came out miles ahead, rather than buying a brand new car. It’s a risk you take, but in our case, it was worth it over the long haul.

What’s worse than repairs? Repairs AND a car payment!

Brand new, the Audi would’ve been about $40k, the Escalade about $60k, the Traverse about $35k, and the Yukon XL about $60k.

Here’s the math breakdown from 8 years of car purchases so you can see what I’m talking about:

| Vehicle | Purchase Price | Repairs | SOLD for |

| 2003 Escalade | 8,500 |

600 |

7,000 |

| 2005 Audi A7 | 7,500 |

2,300 |

6,500 |

| 09 Chevrolet Traverse LTZ | 8,500 |

50 |

7,000 |

| 06 Yukon XL Denali | 7,500 |

500 |

N/A |

Do you see how used cars don’t lose value like new cars? That’s more money in your pocket.

Remember, this is for an 8-year span. It includes all car repairs, and the two times we needed towing. This doesn’t include tax, title & license since it’s different wherever you go.

Your head may be spinning with numbers right now, but the point is this:

If we would’ve stayed on the same path we were on, only buying new cars (or even slightly used cars) with car payments, we would have paid over $60k-70k-80k in the span of 8 years, maybe even more! Holy moly!

Would we have done this differently if we went back in time? Yes, there’s a few things we would’ve done differently to save even more money and less headache. If we would’ve just kept the Escalade from the beginning, we may still be driving it, who knows? But still, that’s a lot of money saved!

Again, this is NOT what it has to look like for you. Our family was growing, jobs were changing, and we had different levels of goals during those moments of time. We did what we thought was best for us at the moment. The point here is that we paid a fraction for what it really could’ve cost us (even with repairs).

The car we drive now with over 200,000 miles on it is just temporary to get us where we’re going. It’s a sacrifice we’re making for a very short time, and then we’ll upgrade soon enough. Even if we have to get towed, we have an emergency fund to back us up. No hurt feelings and I can still sleep good at night. If I need to buy a beater car in the meantime, I’m totally cool with it.

We have goals to crush. Taking risks and crushing goals is now our game.

Everyone’s situation is different, and that’s why I’m going to explain that what may be best for us may not be what’s best for you when buying cars with cash.

But ONE thing remains true for everyone:

Car payments hold you back.

Are you ready for a culture shift? Are you ready to be different? Are you ready for a change? Then keep reading.

What if you bought a car with cash for only $2,000. It looks bad on the outside, but it drives like a champ. You only do this for about 10-12 months, but for the sake of easy math, let’s say 10. Instead of a $400-500 car payment you used to have, you now put aside that money every month for 10 months. At minimum, you’ll have about $4,000 + the sale of your beater car for about the same price you paid for it ($2,000). Now you have $6,000 to spend on another beater, except this one will be a little upgrade to get you by for another 10-12 months.

You get the idea. Now you’ll have about $6,000 from the sale of your upgraded beater AND another $4,000 – $5,000 you’ve been saving. You now have $10k-$11k to spend on an even better upgraded used car that should last you at least 5 years are more. You can do the same thing 5 years later and keep saving, but it gets better.

It doesn’t stop there. If you’re happy with your cash-paid-for car, you could now invest that car payment into a good mutual fund earning at least 10% return. After 10 years, you’d have over $100,000 in that fund! Yes, please!

In 30 years, that mutual fund would be worth over $1 million. Have I changed your mind yet?

For the sake of buying cars, let’s just say that you took out one-fourth of that mutual fund after 10 years to buy a new used car for $25,000. You could get a really nice slightly used car for $25,000 couldn’t you? You wouldn’t even have to put another dime into that fund ever again in order to supply yourself with a new slightly used car every 5-10 years, plus extra.

You could certainly do that on a smaller scale to fit your needs, but the point here is that most Americans are spending wayyyyyy too much money on things that go down in value, and it’s stealing from our hard-earned income every single month!

If you already have a car that’s almost paid off, and you like it, just keep it a little longer after you pay it off while you save up for your next cash purchase. You’ll never regret not having a car payment!

Remember, there’s nothing wrong with having a nice car, but don’t let the nice car have you.

I hope this motivates you to take a look at your car payments in a new perspective.

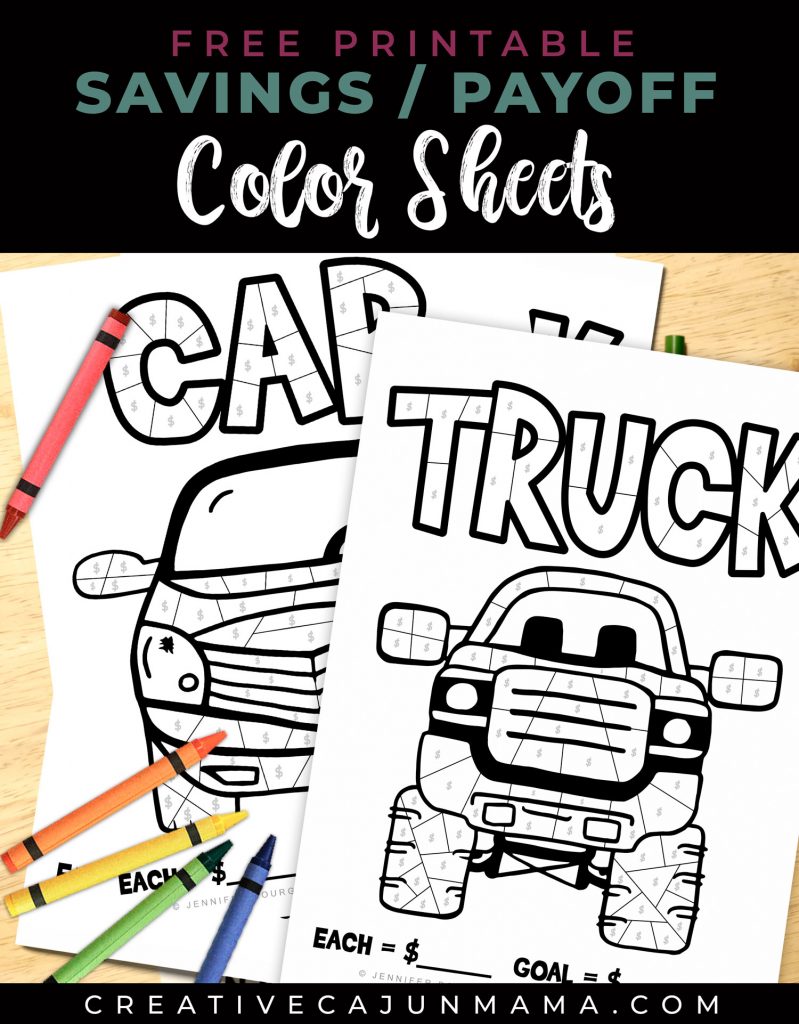

Get these hand-drawn color sheets I created to help keep you reaching your financial goals!

How to use the color sheets: There are 75 sections with a gray dollar sign on them. Whatever you want your future savings amount to be or whatever your payoff amount is for your vehicle, you would divide that by 75, and write that amount in the blank “Each = “. For example, if my goal is $15,000, divided by 75, would be $200. If it’s an uneven number, simply round up to the nearest evenly divided number.

Once it’s ALL colored in, you’re all saved up or all paid off!! This can be a SUPER EXCITING visual to help you reach your goals!

4 Most Important Things I’ve Learned About Debt

4 Most Important Things I’ve Learned About Debt

Awesome, awesome. I just bought a slightly used SUV. Lol, the big note. Love it but really wish I would have kept my paid for truck.

Oh how I would’ve done things SO differently years ago! My first car was an Oldsmobile Alero, and nothing was wrong with it when we traded it! I got barely anything for it. We’ve learned to always sell to an individual to get more for a really used car.

Thanks for the Car/Truck Savings/Payment Trackers. I just started to save for a new car and I plan on paying cash for it. The trackers will really help me to keep track of where I am on my goal.

Yay!!! Exciting!