I don’t want to carry that much cash around.

If I carry cash, I’ll spend it.

These are common reasons not to carry cash, and I’ll be the first to admit that I was hesitant about the “cash envelope system.” Once we started using it though, we noticed something very different happening with our checking account. I’ll also talk about a more modern way to use the cash envelopes if you’re not into using cash, but before I get into those details, here’s some facts:

Our brains literally sense “pain” when we make a cash transaction. It signifies the brain that you are losing something valuable. Even if you don’t think you feel it, it’s what’s going on in your brain.

When we use a credit card, there’s no real pain transaction in the brain. It’s almost like our senses are relaxed, as if we subconsciously know we’re not paying for it right now. It’s a tiny more painful when using a debit card, but it’s still not as painful as cash (cited reference).

This is hard evidence of how using a card to pay for things will literally relax those pain sensors, and we’re more likely to spend more money. If all you have is cash, and you know that’s all you get for now, you’ll be forced to make wiser choices and likely spend less.

For the moment all discipline seems painful rather than pleasant, but later it yields the peaceful fruit of righteousness to those who have been trained by it.

Hebrews 12-:11

How does the cash envelope system work, and does it really work?

We learned in Financial Peace University (FPU) and also mentioned in The Total Money Makeover, that the cash envelope system is the best way to take control of your spending.

Once a budget is in place, you’ve already decided on the maximum amount of money you plan to spend on a specific item (i.e. groceries, clothing, pet supplies, and so on). This is the way our great great grandparents spent money. They didn’t have debit cards and credit cards back then, so when they didn’t have the cash…

Get this…

They didn’t buy it!

Isn’t that something?

In a conversation with my grandma who was born in 1938, she said that she bought only one thing with debt and never did it again. It was a washer/dryer set, and my grandpa was pretty upset about it. They paid it off as fast as they could, and washed their hands of debt purchases from then on.

Checks were invented long before that, but cash was still the main method of payment. Believe it or not, even today, cash is still the preferred method of payment among most sellers.

Although we use debit cards like it’s going out of style soon, most people prefer cash. It’s tangible. It’s visible.

For business owners, they don’t have to deal with as many fees from credit card companies. Every time that card is swiped, there’s a small fee attached to it for the seller (not the consumer). Businesses only allow credit/debit card purchases for the convenience of the consumers because let’s face it – if they don’t, they may lose a lot of business.

Okay, so maybe you’re not a business owner, and you don’t really care about all that.

The first time we bought a car with cash, it was the coolest thing ever. We took our time and never felt rushed because we were shopping on our terms, not theirs. If they didn’t want to make a deal, then they didn’t want to make a deal. When you have cash, they usually want to make a deal. Finding an individual to buy from does take a little patience, but generally speaking, everybody likes $100 bills handed over to them instead of having to go through a bank, transfer funds, sign papers, etc.

Needless to say, I felt a little giddy and tried holding back the smile the very first time I went to the bank to take out $7,500 to buy a car. Like, this was our money! We didn’t have to borrow it!

Using cash from your budget to take control of your money:

Every paycheck, make your budget and take out cash for the specific items you tend to overspend on. For us, this would be things like groceries, clothing, fun money, and misc category. When we were deep in the process of paying off our debts, we had a few more cash categories than we do now.

If you’re serious about getting a hold on your spending, I suggest you start using cash for most of your purchases. But if you do, there are two rules you must follow:

- Set a limit and don’t take more cash out if you run out

- Don’t take money from one envelope and put it into another.

Following these two rules will force you to stick to your budget and learn where to adjust! Don’t worry, you can always adjust.

Sometimes we need to be forced into action, and doing that with your spending is a GREAT way to take control of your money. This is also when I started using extreme-couponing methods to help our money stretch even further. Now that we’re out of debt and a little more relaxed, I don’t use coupons as much, but we still budget every single dollar with every single paycheck, every single month… to infinity. It’s the only way to take control.

We either take control of our money, or we will be controlled by it. We’ll be wondering where it all went! Tracking it and cashing it eliminates that.

SPOILER: Getting started using the cash envelopes is the hardest part. Once you’ve been doing it for a little while, it runs like clockwork. Give yourself at least 4 paychecks to get the hang of it, and you’ll never regret it! Trust me.

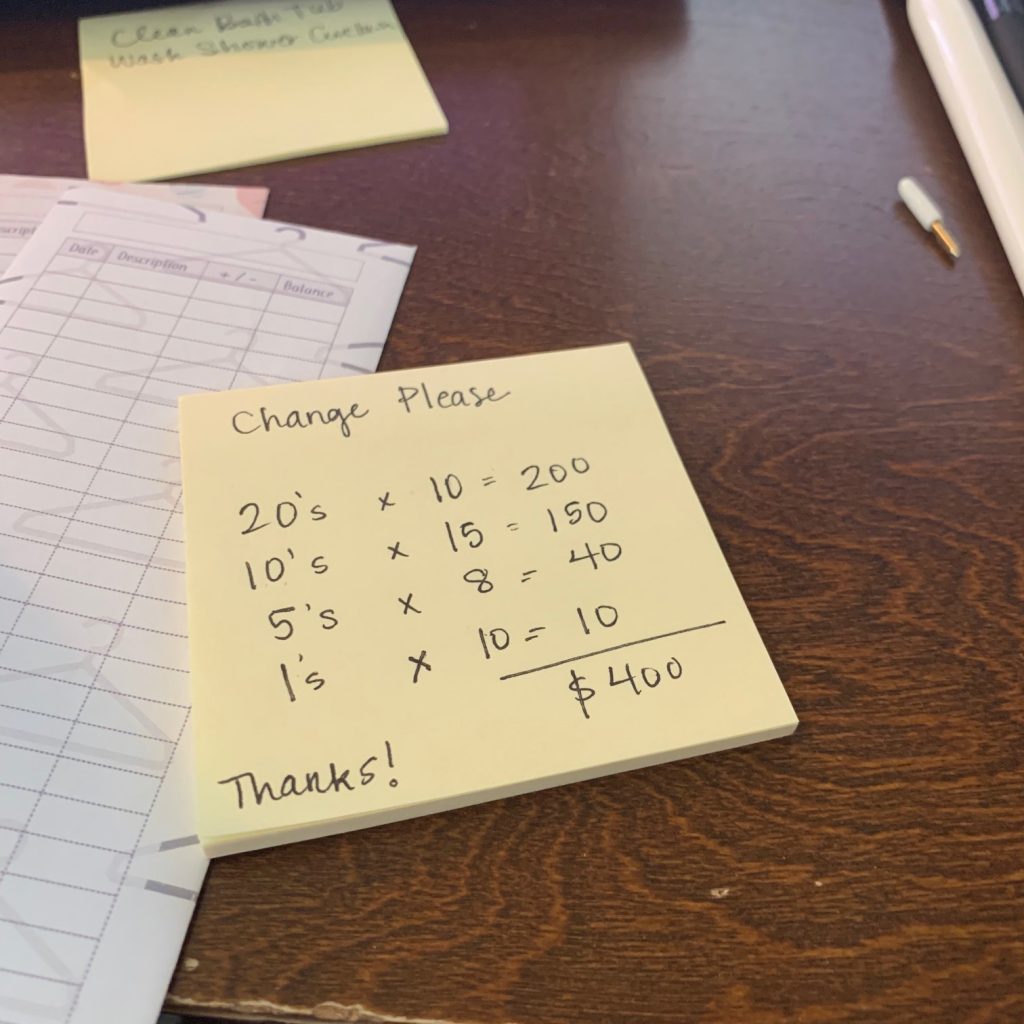

I used to go to the bank every payday and get a lump sum of cash out. I’d cash a personal check for the amount, let’s say $400 and attach a post-it note on it for the teller.

Then, I’d disperse all the cash into the envelopes! No more tons of transactions to track down and organize all the time! Just the normal bills like electricity, water, mortgage, etc. Only thing is, I was using those longggg letter envelopes because I didn’t have access to any cute ones yet like the ones you can download below 🙂

What’s great about using a budget is that YOU get to decide where your money is going before it gets spent. And using cash envelopes can be quite fun once you get the hang of it! You have the freedom to spend within your own limits.

So, therefore, our bank account transformed right before our eyes. It was suddenly under control. So yes, it does work.

Using colored paperclips:

I got this great idea from Dave Ramsey’s daughter, Rachael Cruze. If you don’t want to use envelopes, you can use colored paperclips. For example, I used green for groceries, blue for clothing, and red for misc. Then, I’d just put the cash in my wallet like that with the paper clips on it. All the change went into the change pocket or a coin purse.

What to do with all the change?

Challenge yourself with a change savings! Once your coin purse or coin pocket gets full, empty it into a large glass jar or container. Once it’s all filled up, you’ll have a few hundred dollars in there. It’s a great way to force some small savings into your life without even having to try so hard! Challenge accepted?

Using an App instead of cash:

If you’re not wanting to use cash at all, you can certainly deal with all the card transactions from your bank account every month. It’s mostly what I do now, but when we were first starting out, we used only cash for many of our purchases. It’s the BEST way to take control of your spending.

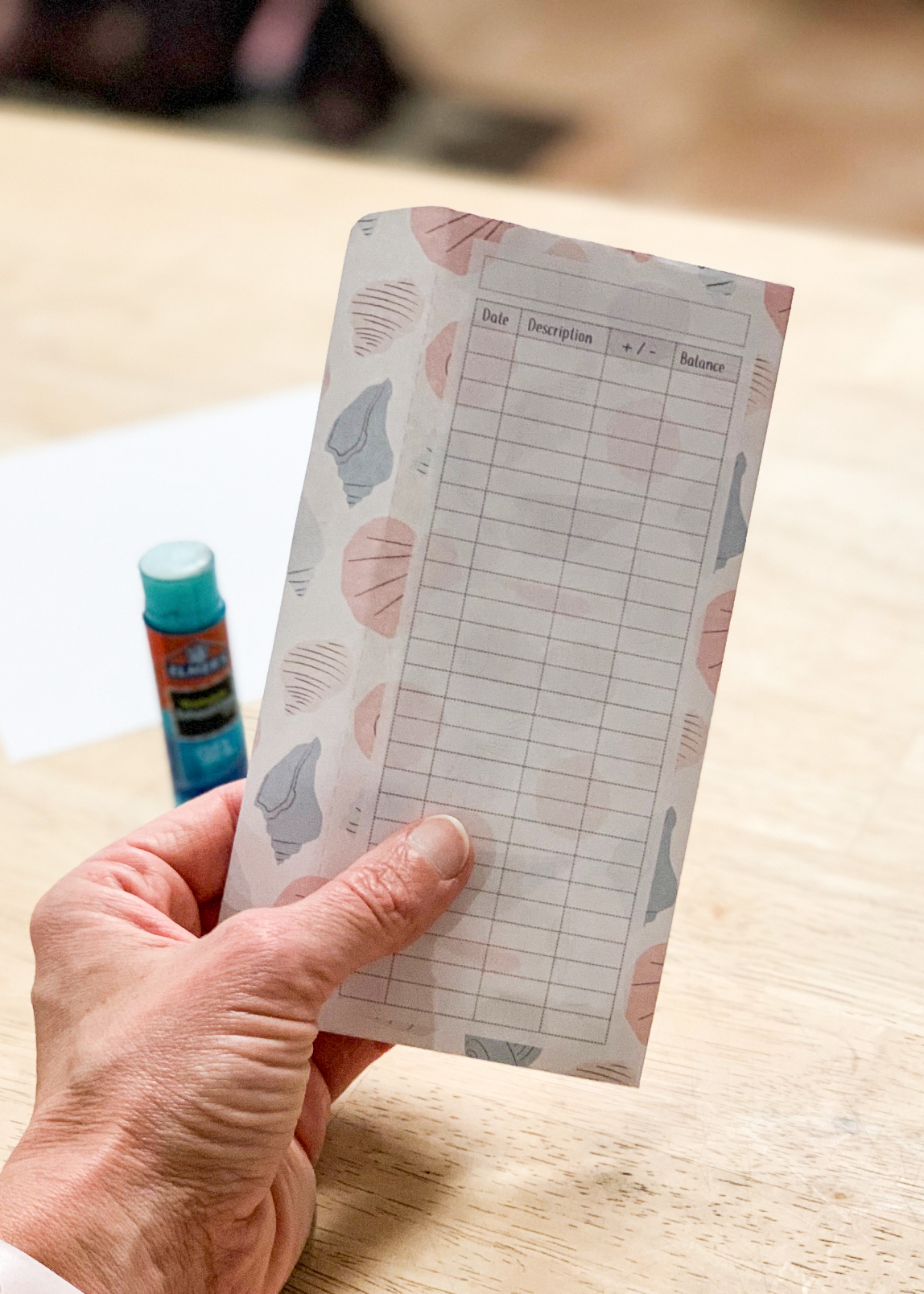

Ramsey solutions has an app called Every Dollar, which encourages you to budget every single dollar before you spend it. It’s the best budget app out there, which also acts like a “checkbook” that records every single transaction you make. This is actually what we use now for our checkbook records and tracking all of our spending. I can go back a few years if I want to.

It’s a great way to track your spending if you’ve already gained control of your spending. It’s NOT so great if you haven’t already gotten your spending and budget under control. The reason is because it’s MUCH easier to “let go” whenever things get out of control again. Let’s say you overspent in the clothing category, and you got busy and waited too many weeks to input it into the app. It will take a lot longer to get back on track and track your spending again and trying to also keep up with all the other transactions. Now, you’ll have to go back on your bank account and track every single transaction you’ve missed over the last few weeks. This will probably take you a few hours, and since you’re already busy, you may never get back to it.

Taking cash out eliminates all the hours of tracking because the cash is right there in your wallet to spend. You simply keep track of the cash spent from the envelopes, and when you run out, you’re out!

The cash envelopes FORCE you to make the best out of what you already have, and it certainly teaches you to choose wisely.

If you’re already feeling out of control with your money, I want you to start using envelopes (or paperclips), and let me know how your spending changes!

These super-cute printable envelopes fit perfectly into my wallet! See, it fits oh so conveniently right next to the ever-so-dangerous Target Debit Card.

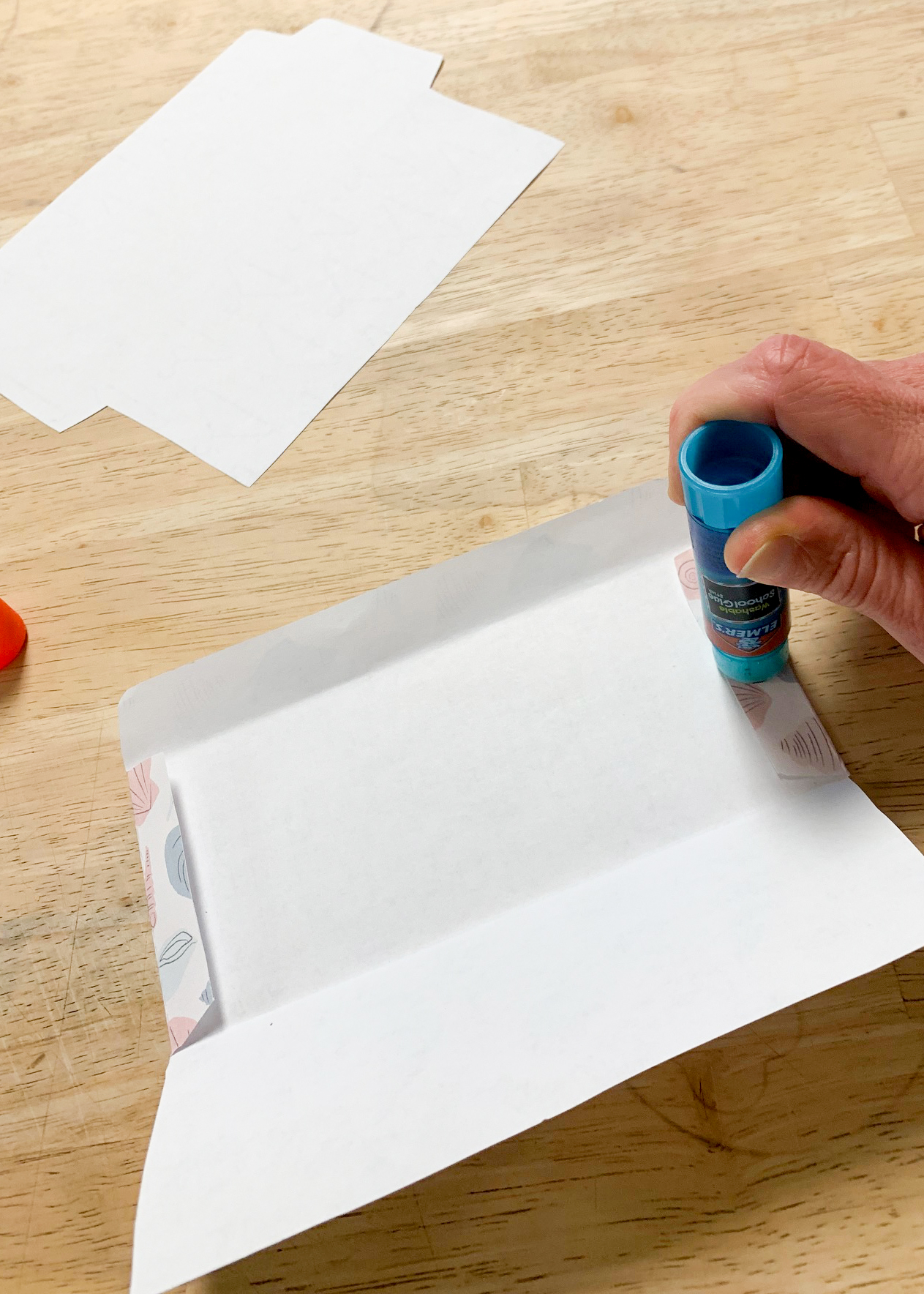

I’ve designed a few envelopes for you to get started! And so you don’t spend too much on ink, I reduced the transparency to create some pastel colors. I’ve got floral, pineapples, seashells, dogs & cats, birds, piggies, and clothing hangers. Get yours below!

Instructions:

Why We Pay CASH for Cars and How You Can Too

Why We Pay CASH for Cars and How You Can Too

Thanks Jenn you put so much into this for us. Very much .appreciated

No problem! So glad you appreciate it! 🙂

any advise on categories?

Hey Amanda! Do you mean which categories should be cashed?

These are so awesome and thank you for the designs! 🙂 But I and my husband found that they need to be a 1/8 inch longer to fit bills.

Thanks for the input! They don’t fit a ton of cash, but I have about 20 bills in one right now. I can definitely make them a little bigger For you 🙂

Jazzlynn, make sure to DE-SELECT the option to “Auto-rotate and center” in the Print Dialog box if you have that option. This makes the document auto-fit onto the page and may reduce the size a tad bit.

I am trying to print these and it is coming out way to small. Do you know how to fix that?

I figured it out! Thank you for this great resource!

I registered and tried using the resource library to print up the cash envelopes but I was asked for a password. I was never asked to create a password when registering only my name and email. Not sure how to access the “free” library. I tried using the email link on the website but it didn’t work. Any suggestions? Thanks

Hi Nicole! You should’ve received another email shortly after “confirming” your email address. Especially if you have gmail, it tends to get dropped into the Junk/Spam folder. Please check that folder also. This is an important email that has the password and all the info you need, and I introduce myself. I send out a newsletter on the first Sunday of the month that has the password in it as well. Please let me know if you didn’t get the email in your junk folder and are still having trouble, and I can personally send you an email 🙂

I did not receive email for printables

Hi Malorey, please email me at jenn@creativecajunmama.com, and I’ll make sure you get the email! It’s showing that you never confirmed your email. This is to prevent spam on the site. It most likely got sent to your junk/spam folder. Please check there first. Thanks!

I signed up and confirmed my email but have not yet received the email with password. I did check my spam folder.

Thank you, Jenn! I love your designs. Thank you for your advice, too. 🙂