When we first started budgeting the “Dave Ramsey way,” we used a minimal amount of cash envelopes. But now, we’re mostly digital.

If you’re just getting started with budgeting and taming your money better, these cash envelopes are definitely the best way to start out. I’ll explain what we did before, and what we use now that we’ve taken control of our finances and paid off our consumer debt on purpose.

In this post, I’ll go into detail about the budget categories we use and some others that are really important to have.

In the beginning, we had major categories like Groceries, Clothing, Toiletries, Restaurants, Misc, etc. We kept other categories and “sinking funds” in our safe – things like Home Repair, Car Repair, etc. This was just getting our feet wet using zero-based budgeting like Dave teaches.

Immediately, within two weeks, we began seeing changes in our finances. Even though we were always frugal spenders, we frequently seemed to have too much month left at the end of our money. But with the envelope system, we were forced to stick to a cash-only budget for these main spending categories.

People freak out nowadays about carrying that much cash on them at all times. I can understand there’s a risk of it getting lost or stolen.

View this post on Instagram

After several months to a year of doing this, we really got the hang of it, and we were paying off debt really fast! I then developed a system on Excel and created a binder with more categories, like Medical, Fuel, and things we really felt we needed to use our bank card for.

It wasn’t until after we paid off our debt that the Ramsey team developed an app called Every Dollar. It was basically what I had created in my binder! But now it was electronic. Perfect!

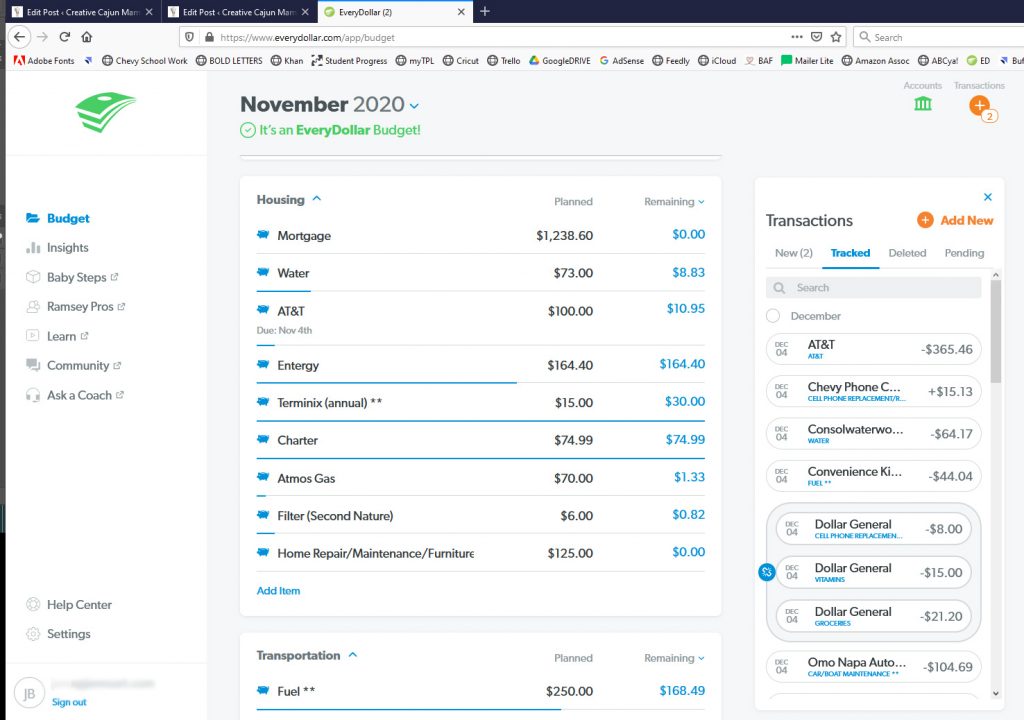

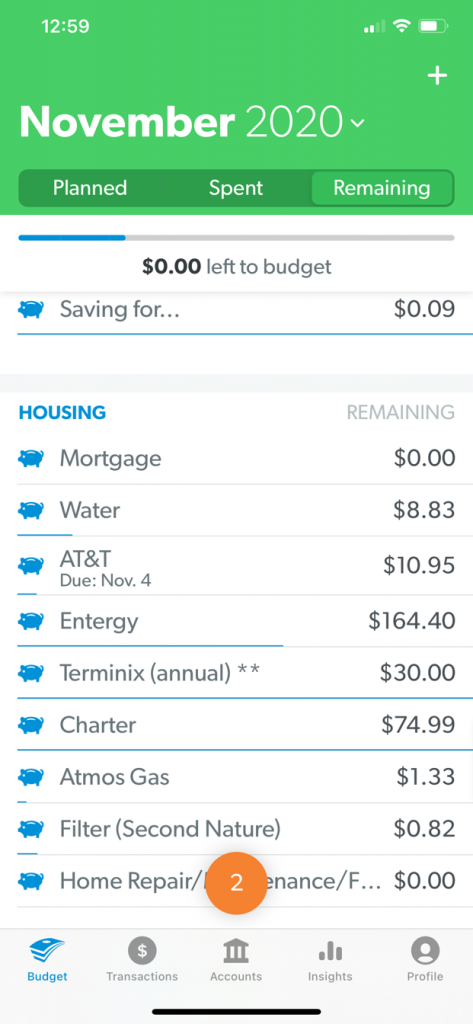

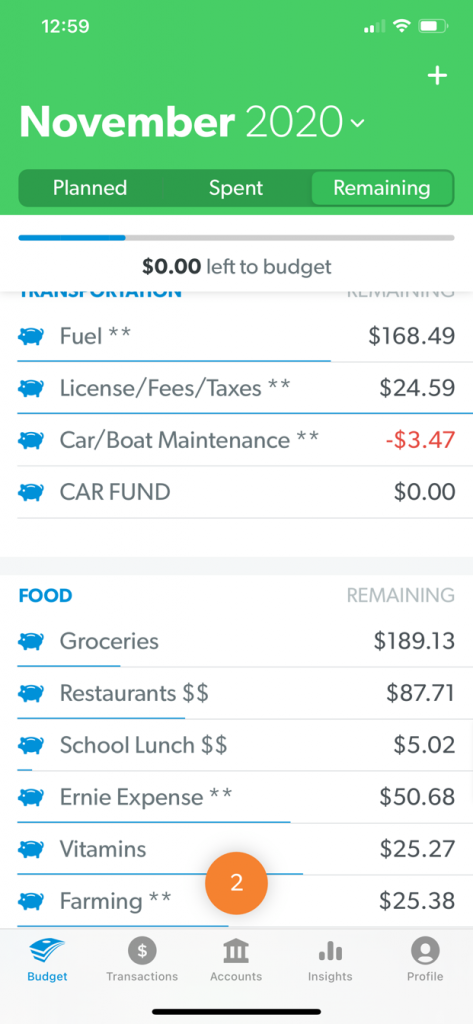

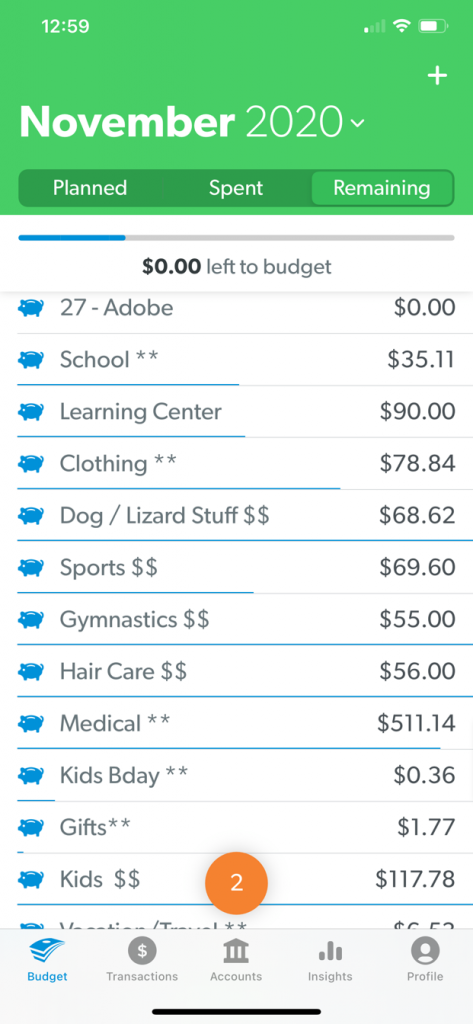

Now, all the “envelopes” are basically digital categories that I’ve set up as “funds” in Every Dollar.

It’s not only on an app, but it’s also conveniently accesible on your desktop with all of it stored instantly as you edit anything.

This is now what we use for our budgeting as Ernie and I each have this app on our phone, and it updates in real time. This means that as soon as I enter transactions or update the budget in any way, Ernie can see it on his phone just by pulling up the app. He can see how much money we have left over in certain categories and even edit himself if he’d like.

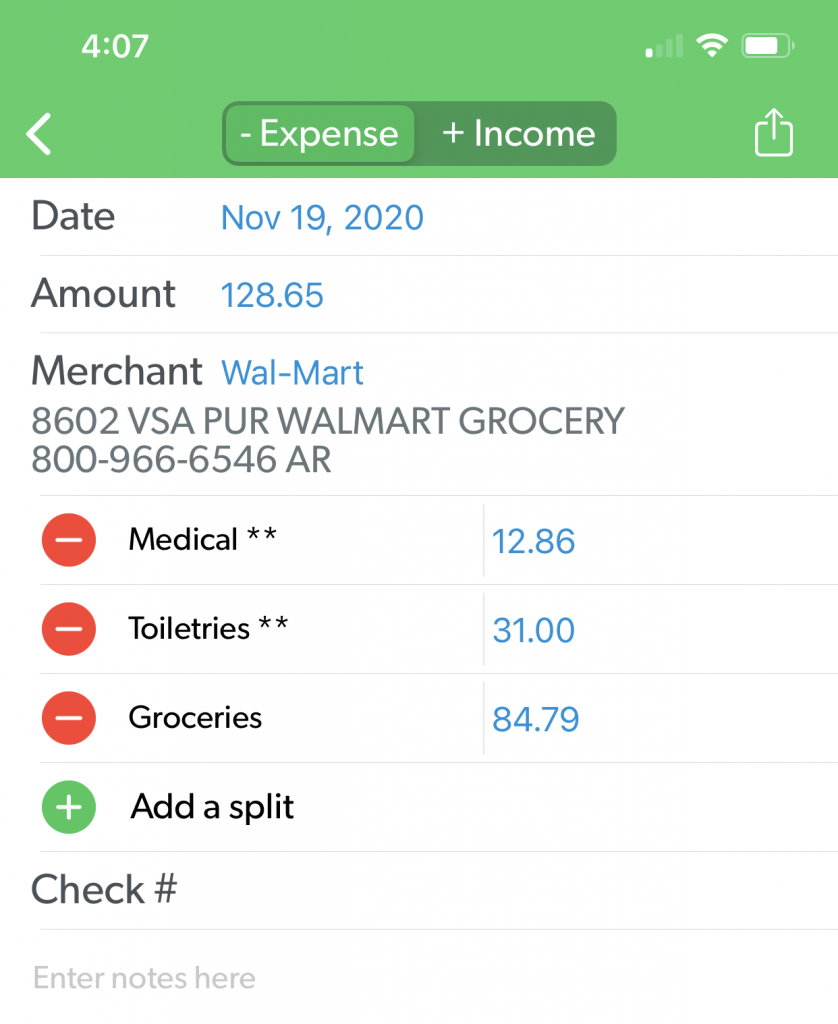

You can even split transactions. When I go to Wal-Mart, I buy more than just “Groceries.” Sometimes, there’s clothing, toiletries, medical supplies, etc.

We went a couple years using the free version, but then upgraded to the paid version to connect to our bank account – it saves a LOT of time being connected because we can just drag and drop transactions, instead of having to go through every single transaction on our bank account and input it in. If I had more time to do that, or if that’s something you enjoy, have at it! *this is not a paid advertisement* I love Every Dollar. It costs roughly $10/month for the paid version, and it’s well worth the time saved.

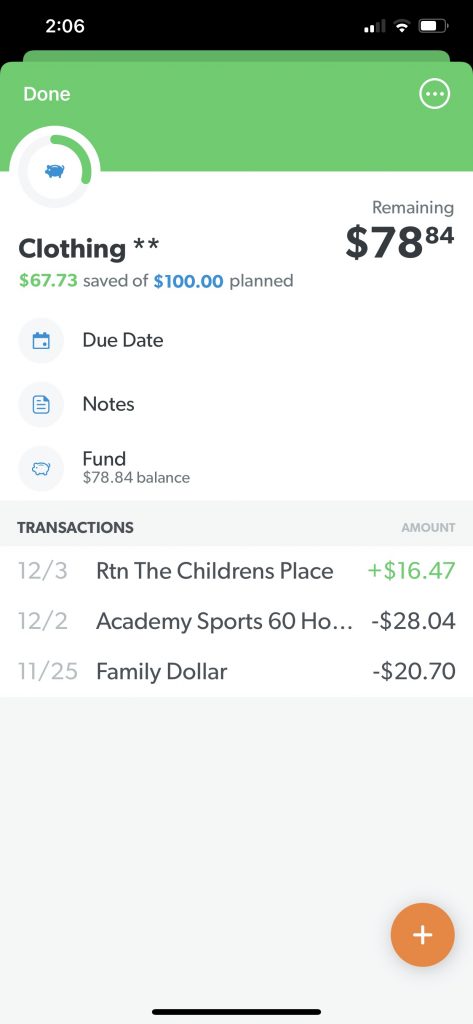

If you click on a category, you can see all the transactions that took money in and out of that fund. Just like if you had an actual envelope with $100 in it, and you spent $80 of it at the mall on clothing or at Target for new underwear, those transactions will be listed, and your total amount remaining will show up here also.

So, we treat these digital categories the same way we treated our cash envelopes – don’t spend the money if it’s not in there! If we absolutely need the thing, which is usually the case for “Toiletries” sometimes, then we must sacrifice a few dollars or so from another category in order to make it work (I mean, when you need toilet paper, you need toilet paper LOL). Money doesn’t fall out of the sky to make up the difference, and we certainly aren’t racking up a balance on a credit card for money we don’t have at the moment.

This is how we’ve been able to pay cash for our vehicles and save up for other major purchases. We are not, by any means “wealthy” at this point. Actually, most of our friends make more money than we do. Yet, we’re able to live without debt, pay cash for our cars, and we recently just finished building a tiny house for Ernie’s mom (more on that later).

THIS. STUFF. WORKS.

What categories should I use?

Anything you spend money on.

Yes.

That means everything.

Trust me. This is how we are able to do what we do, and live how we live. We plan out everything, even though not everything goes as planned. Everything not always going as planned is NO excuse to not plan at all!

Make a plan!

Our categories have grown over time, and like I said, started off with the main categories mentioned above. It was obvious at the time what envelopes we needed money for the most.

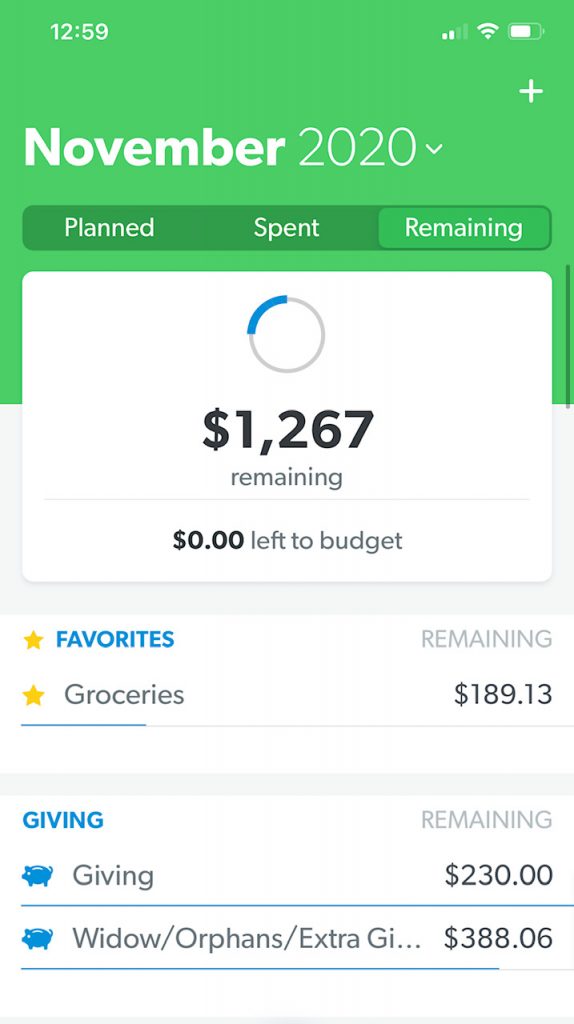

But over time, and especially having a little more freedom after paying off debt, our categories have grown drastically. We now have over 50 categories, which includes everything from monthly bills like the mortgage and electricity, to things like sports, life insurance, and Amazon Prime yearly fee.

Here’s some examples of the many categories we use:

The $1267 is not a checking account balance — it’s basically telling me what I have left to spend, according to what I’ve budgeted. I don’t use that amount for anything. We base our spending off of what is left in each category. The actual checking account balance would essentially be ALL the categories’ “Remaining” amounts all added up. That should match the bank balance.

Some categories not shown here in these screenshots:

- Cell phone replacement / Repair

If you have a cell phone, you know that from time to time there are repairs or replacements that happen! Put aside at least $10/month that you don’t touch. That way, when it comes up, you’re not having to bust another budgeting plan in another category or ruin something else you had planned just because your cell phone broke. These things happen, and we know they do. - Miscellaneous

This category catches the little things that we forgot about. We put about $50-80 every paycheck in there (that was AFTER we were debt free). Before we paid off all debt, our emergency fund was there to catch any emergencies. This Misc category is there to give a tiny cushion to things we forgot about that maybe we didn’t have a category for yet or something came up that we didn’t plan for. For example, I recently bought the kids these timers to brush their teeth to make sure they’re brushing for at least 2 minutes! That fell under miscellaneous just because I didn’t know where else to put the transaction, and there was money left in there to use. - Insurance

I will emphasize one in particular. If you don’t have life insurance (10x your yearly salary), GET IT NOW. For term life insurance, we literally pay $35/month to cover Ernie and $18/month to cover me and the kids in the event one of us would die. If you don’t have this type of life insurance in place that is SEPARATE from your workplace, don’t waste another second (If you were to lose your job, your life insurance gets cancelled too, then you’re older, trying to get it again is more expensive. Trust me, just don’t go through work; there’s more reasons.). Call Zander Life Insurance. We loved working with them, and it was easy. If you choose someone local, make sure they’re a brokerage that searches out different companies (that’s what Zander does). This is not only to cover burial or outstanding debts, this is to cover the rest of our life! This is to make sure that we could continue the same exact lifestyle, financially speaking, in the event one of us would die and not have that income coming in anymore. When someone dies, it’s enough to have to deal with the grief, but why add to it with financial burden on top of that?! - Memberships

Whether this is for Amazon Prime, a gym, a video streaming service – if it’s a yearly fee that you pay, then divide it by 12, and that’s how much needs to be saved up every month to be able to have that sitting there waiting to be paid when it’s time.

The one people get antsy about the most is FUEL. It’s not that complicated and will never be exact. If you know you fill up once a week, figure out about how much that would be. “But we go out of town sometimes.” Yep, us too! Think ahead as best you can. Put a little extra in there even if you’re not going out of town, just in case. If we know we’re traveling for baseball for two weekends in a row, we plan for a couple extra tanks of gas. If it doesn’t get used, it doesn’t get used. Better safe than sorry.

If you’re just getting started with categories, you may not know exactly how much to put into each category. This forces you to start paying attention to what you’re spending money on and HOW much you’re spending! Put down what you think you’ll need, and if it wasn’t enough or it was too much, adjust accordingly. Remember that no two months are alike, as there are different expenses each month. Birthdays, holidays, seasonal sports, etc. Plan ahead as best you can, and give yourself time to get used to it.

For all you perfectionists out there – it will never be perfect.

What is a “sinking fund?”

A sinking fund is basically a fund for what you’re saving up for. And this app makes it really easy to look and see what you have saved up so far.

For example, right now Amazon Prime is a yearly fee of $119, plus tax = 130.84. If you divide by 12, you get $10.90. That means I need to be saving about $11/month to make sure I have enough saved for Amazon Prime when it gets automatically deducted from our account in December.

This can be used for anything, such as vacation. If you need $1,000 for vacation, figure out how much you need to save per month in order to meet your savings goal. It’s basically another word for “saving up” for something.

I even have a sinking fund for our driver’s license and hunting/fishing license renewals. That way, when it’s time to pay for it, it doesn’t ruin the plans of other things I needed to pay for. The money is already there. See how this works?

This has literally saved us from using up money we could have set aside for FUTURE plans and things we wanted to do later, but we forgot about or something came up that prevented us from continuing to save.

What if I have more than one account?

We use our “Main” checking account as the main budgeting account, and then set up categories for our other accounts. We type “(separate account)” next to the name of the category so we know it’s a separate account that we don’t count toward the total amount in the Main account.

This way, we don’t need a separate Every Dollar account for every account that we have. MUCH easier to manage all the accounts in ONE place. All the transactions from that account will also be listed, and the total amount remaining in that account will show as “Remaining.” This should match the bank balance for that account.

For example, our Emergency Fund is split up into more than one account. We keep an Emergency Fund “cushion” in our Main account, but also have an Emergency Fund in a separate account. That category is named “Emergency Fund (separate account).” This is just an example, so you can certainly name it what you want.

Budgeting doesn’t have to be boring.

It can actually be really exciting! But it can also cause fights between couples. A disagreement can bring out changes that need to be made. When you start to see your savings goals come to life right before you, and you start to experience the priceless feeling of things being “taken care of,” you will be glad you have a zero-based budget. You’ll also have the weight off your shoulders to be prepared (for at least most things) when the unexpected happens, which is basically all the time.

I hope this helps you to take a look at what categories you may need in order to budget and plan ahead successfully.

Get my free printable cash envelopes HERE, which gets you access to my Free Resource Library and my random newsletter with all the latest posts.

Instant Hot Cocoa Mix

Instant Hot Cocoa Mix